DBS bajaj finance Super credit cards –

DBS bajaj finance Super credit cards 2023-2024 DBS bank has similarly launched co-branded cards with Bajaj Finance. That is Bajaj Finsesv DBS bank super card. It has very different cards 5X, 7X, 10x and includes 5x super card, 5x plus super card, 7x super card, 7x plus super card, 10x signature super card, 10x plus signature super card. We will learn about this card.

1 Fees Super credit cards –

5x plus, 7X and 7X plus cards get remaking cards life time free credit cards. Get 5x and 5x plus credit cards first year Free cards. Joining fee is not charged on these cards but renewal fee is charged from next year. There are no benefits on life time fee credit cards and renewal free credit cards.

Normal super cards are 5x, 5x plus, 7x, 7x plus, 10x, 10x plus. These credit cards are charged for joining and renewal fees. With this you get welcome benefit’s cash point through.

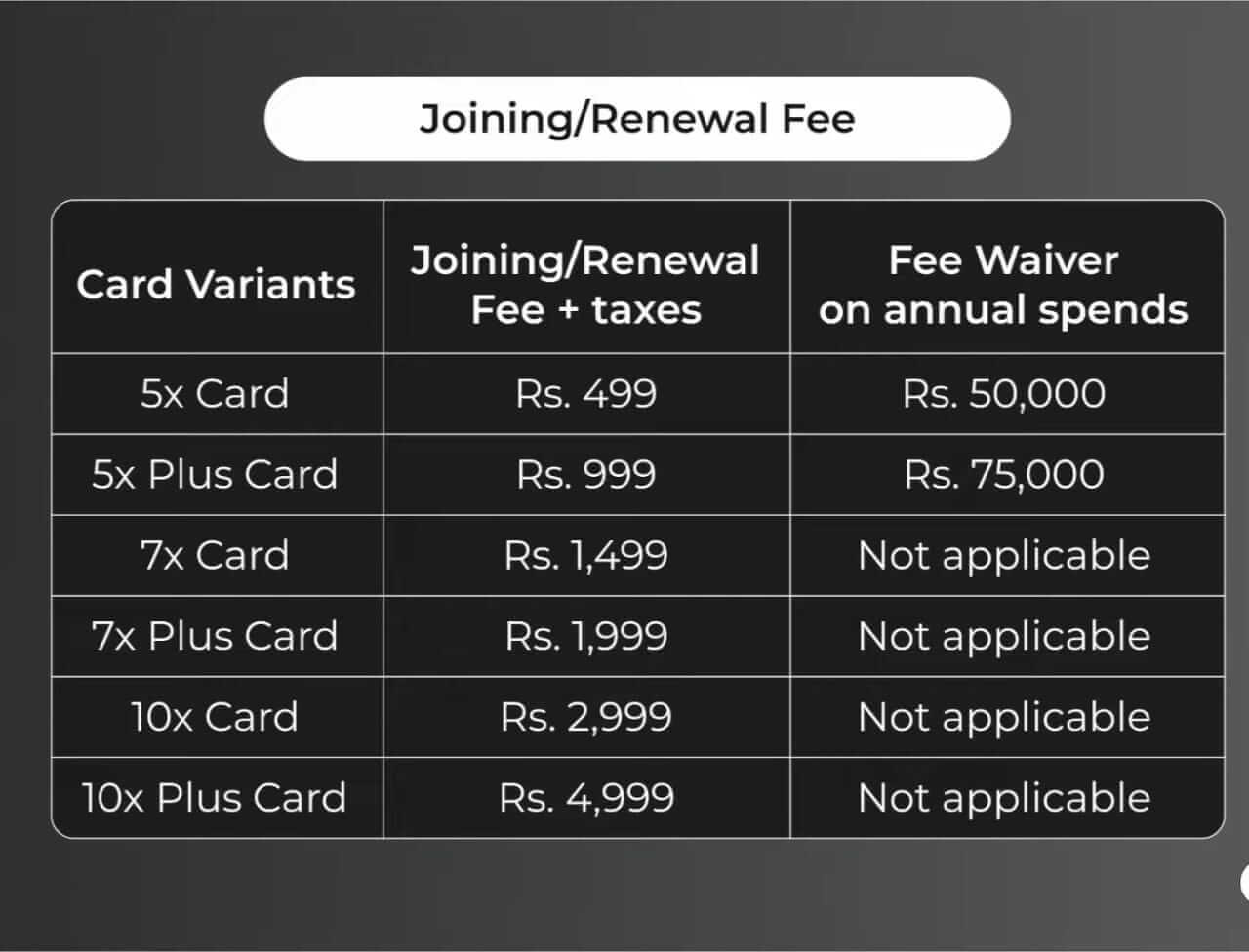

Let’s see what are the fees of this card. 5x card joining and Renewal Fee plus taxes including Rs. 499. On this card plus next year fee waiver on annual spends Rs. 50,000. 5x plus joining and Renewal fee plus taxes Rs 999 and Next year fee waiver of annual spend RS 75 000. 7x card joining and Renewal fee plus taxes RS. 1499. 7xplus credit card joining and renewal fee plus taxes is Rs.1993. 10x Credit card joying and Renewal Fee plus taxes is Rs. 2,399. 10x plus credit card joying and Renewal fee plus taxes is Rs. 4999.

2 Welcome Benefits Super credit cards –

Welcome Benefits These credit cards are available in cash point form. The value of one cash point is 25 paisa. You get welcome benefits when you pay the joying fee on these credit cards, when you make the first transaction within 60 days after the card is issued.

Welcome Benefits Above 5x credit card gets 2000 cash points. You get 4000 cash points on 5x plus credit. You get 6000 cash points on 7x credit card. You get 8000 cash points on 7x plus credit card. 12x cash points on 10x credit card. You get 20,000 cash points on 10x plus credit card.

Joining fees of all these credit cards are recovered due to welcome benefits.

3 Milestone Benefits Super credit cards –

DBS bajaj finance Super credit cards 2022-2024 On these credit cards you get monthly milestone benefits. These credit cards get additional cash back points on a particular amount spend in a month.

These points are found in 5x, 10x and 7x. You will not receive additional milestone cash back points on cash withdrawals, fuel spends and accelerated rewards. But cash withdrawals and fuel spends are considered to achieve monthly milestone spends. On top of 5x and 5x plus credit card you get 5X rewards for what you spend after spending 10,000 rupees in a month.

This means that after spending 10,000 rupees, you get 1x reward and additional 8 reward points for the expenses you incur. Rs. 200 spent above.

Total you get 10 cash points above 200 rupees spend. This way you can earn maximum 3000 cash points on both the cards in one month. 7x and 7x plus credit card above After spending Rs. 15000 and above, you get 7x reward and additional 12 cash points of Rs. 200 spent above. 7x and 7x plus credit card on over all Rs. 15,000 spends are followed by 14 cash points of Above Rs 200 spends.

This way you can earn maximum 6000 Points in a month. 10x and 10x plus credit card similarly spend 20,000 rupees a month then get 10x reward on the spends. That means you get 1x reward and additional 18 cash points. Each Above Rs.200 spends. 10x and 10x plus credit card with RS 20,000 spends in a month then spends you can earn 20 cash points.

Above every RS 200 spends. Above each RS 200 spends. That way you can earn maximum 10,000 points. You can earn 15,000 points in one month on 10x plus card.

4 Accelerated rewards Super credit cards –

DBS bajaj finance Super credit cards 2023-2024 Eligible spends are available in the rewards platform on DBS credit cards plus India’s app. Except flight booking spends on DBS card plus app. Get 5x and 5x plus credit card and get 10x rewards on this app through eligible spends. 1x rewards and additional 18 cash points. Each rs. 200 spend above. Total 20 cash back points. Above every Rs.200 spends.

This way you can earn maximum 2000 cash points in a month. This capping is different from monthly milestone capping. Similarly, in the app of DBS card plus India on 7x and 7x plus credit card, you get 15 X reward on eligible spends. Total you get 30 cash points for every rupees 200 spends.

This way you can earn maximum 6,000 cash points in a month. 10x and 10x plus card in DBS cards plus India’s app 20x rewards on eligible spends. Total you get 40 cash points. You can earn a maximum of 15000 points for every rupee above 200 spends.

5 Point Redemption Super credit cards –

The value of one cash point is 25 paisa. You can redeem these Cash points DBS cards plus India app on hostel booking and gift voucher against. You can redeem the statement credit card against these points.

6 Remaining Benefits Super credit cards-

On all these credit cards you get health benefits from bajaj fenserv. In which you get three teleconsultations on bajaj Finserv health mobile app from general physician at Rs. 75 per month.

Lounge Benefits – Lounge Benefits are not available on 5x credit card. Up to 5x plus and 7X credit card one domestic lounge visit in a quarter. 7x plus and 10x plus credit cards get two domestic lounge visits in a quarter. You get eight domestic and two international lounge visits on 10x plus credit card in one year.

7 Membership Benefits Super credit cards –

You get membership benefits on this card. In which cash point variants get 20% discount on eligible memberships purchases on DBS cards plus India’s app. Get 5x plus, 7x, 7x plus credit card and 40% discount on 10x and 10 plus credit cards.