IRCTC SBI Premier Card full details in 2023 –

IRCTC SBI Premier Card full details in 2023-2024 After hearing about IRCTC card changes, many people may have thought that travel, train etc. But on this card you get benefit of hotels, flights, buses etc. You can do –booking. Did you know that? I’m sure you know. IRCTC has two SBI partnership cards.

Let us see the information of one of these two cards. That’s IRCTC SBI platinum credit card. Because IRCTC is the premium version of SBI platinum credit card. We will see in detail whether this card is good or not.

SBI has a lot of travel centric credit cards. Yatra, Etihad, Vistara, Air India etc. Let’s see the basic details of IRCTC SBI premium credit card.

1) Joining and Renewal fee –

IRCTC SBI premium credit card joining and renewal fee is Rs.1499 plus GST. Joining fee was waived due to receiving welcome benefits.

2) Welcome Benefits–

Welcome to Benefits Gets 15000 Reward points. These are obtained after paying Reward Point Joining and Renewal Fee. Reward point value is one reward point equals to one rupee. Renewal fee was waive of Rs.2 lakh spends on annually.

This is a travel specific card so let us see the travel related benefits. The rest of the benefits are not very good. Within 35 days of starting, you get 3500 Reward Points when you transact more than RS.500 using this card. You get Rs.100 cash back when you withdraw cash using this card. But after cash withdraw you have to pay a lot of charges

3)Eligible Criteria –

IRCTC SBI Premier Card full details in 2023-2024 For SBI IRCTC visa platinum credit card your income should be Rs.20,000 per month, to get this card you need ID proof, income proof and passport size photo. This is a normal entry level card. Benefits are provided only on IRCTC website and IRCTC application.

4) Reward Points –

10x Reward Points on IRCTC SBI Premier card on first, second, third and AC chair class if you purchase train ticket using IRCTC credit card. When you purchase e–catering and fight tickets using IRCTC primer credit card, you get 5% reward points.

5) Reward redemption : –

Earned points are transferred to IRCTC Loyalty account and you can redeem on IRCTC website or IRCTC mobile app. Before that you need to link the IRCTC card number with IRCTC’s loyalty login ID. There are many travel related options on IRCTC Credit Card for redeeming points.

There are many options like international domestic packages, tourist trains and many more. Corals packages are also available on IRCTC. There are so many travel and torment related options available on IRCTC that you can redeem the earned reward points in a very good way.

Specially fantastic value of one reward point equals to one rupee. But the actual return rate on this card which claims that is 10% on train tickets and 5% on flight tickets. You get a lower reward rate than that.

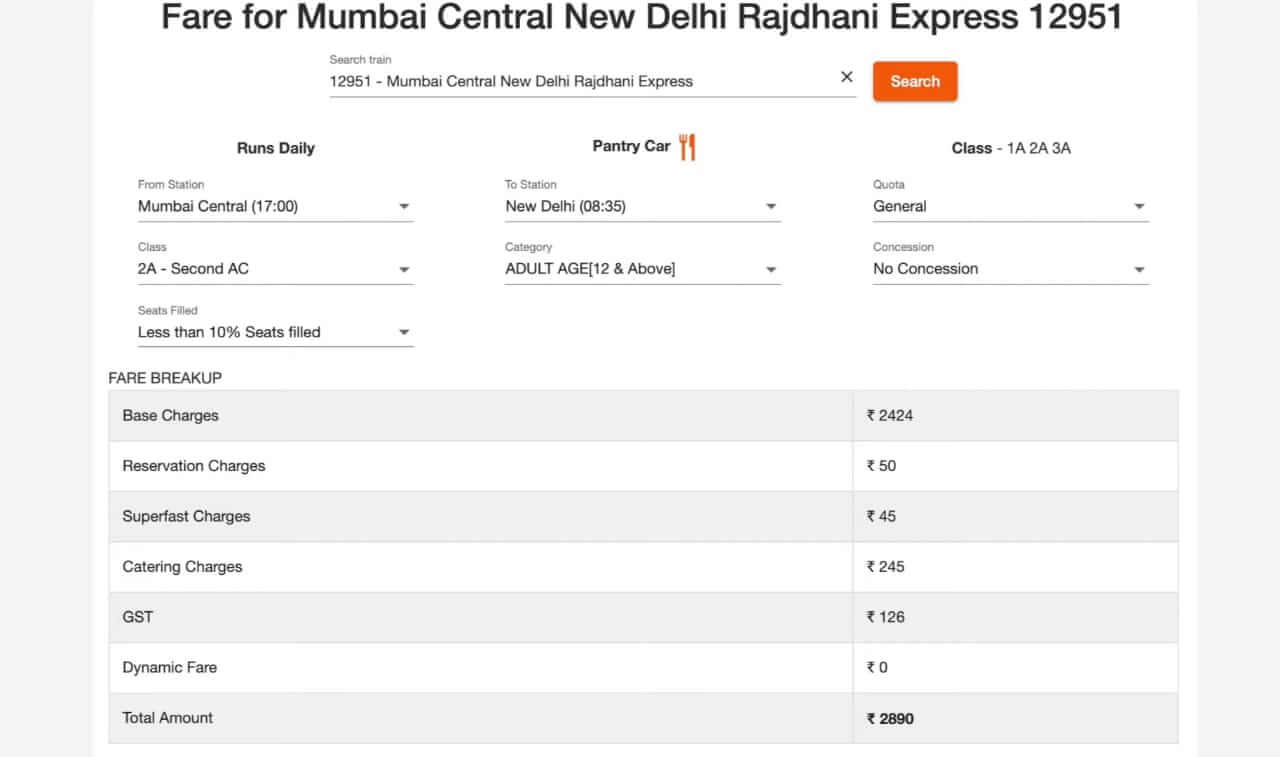

• Let’s take an example. Let’s assume second class train ticket from Mumbai to New Delhi. It gets 10% returns on base charge.

IRCTC SBI Premier Card full details in 2023-2024 In this image you can see the base charge is RS.2424. You will get 10% return on the base charge. Not on the total amount. From this you may have understood that actually return is not 10% but actually comes up to around 8.3% similarly 5% reward above the base amount of air ticket. This will result in at least a return of less than 5%.

• Let’s understand with an example– Let’s assume the Air ticket from Mumbai to Bangalore whose total amount is RS. 5161 but its base amount is Rs.4376 if the return rate is calculated above the base charges then it comes up to 4.2. which is lesser than 5%.

Note one more important point you get reward points only on card holder ticket. If you have other travellers with you, you will not get reward points on their ticket. There are generally no benefits for most of the cards on trains. But IRCTC credit cards are available.

Apart from this benefit, you get very few other benefits. Another great option than this card is HDFC diners black. This credit card offers approximately 15% return rate when you book on IRCTC primer credit card.

There is no condition above that only reward point will be given on card holder’s tickets. You can get the same benefits even book the tickets others using HDFC Diners black. Clearly much better option.

But not everyone can take these credit cards and RBL has imposed restrictions on the card to issue new cards .

6 ) Other Benefits–

Apart from travel benefits, you can get some more benefits on this card. Maximise way using yaper app. You can make purchases for non credit card users. When railway and air ticket is booked on IRCTC website using IRCTC SBI card, transaction charges are 1% to 1.8% respectively.

Fuel surcharge is also waived on this card. This benefit is not special because this benefit is available on most of the other cards. If you consider the transaction charges on railway and air ticket, you can save descent amount.

7) lounge access –

On this card you get Railway lounge access. Which is eight complementary lounge access in a year that is caped two per quarter. But railway lounge access is only available on limited cities and stations.

This is not a very good benefit. Ideally, if railway port lounge access and air port lounge access were also provided, this benefit would have been very good. On each RS.125 spends you get three reward points. On dining and standing instructions on utility bills.

The rest of the detail purchases including fuel, Railway purchases get one reward for every Rs.125 Spent. Milestone Benefits But RS.50,000 Annual Spent on IRCTC You get 25050 reward points. Which is a benefit of 250 rupees. On RS.1 lakh annual travel spends on IRCTC you get 5000 reward points.

Which is a benefit of 500 rupees. With so many restrictions, it is very difficult to achieve milestone benefits. The reward point on this card is given only when the card holder travels. This makes this card very unattractive.