indusind bank club vistara explorer credit card –

indusind bank club vistara explorer credit card review 2023-2024 There are three types of vistara cards: entry level card, premium cards and super premium cards. Of these Super premium cards are only available with Axis banks in the form of Axis vistara infinite card. But now this has changed because Vistara has launched club vistara IndusInd bank explorer card with IndusInd bank.

We will discuss all the features in this article. Let’s compare these features with Axis Vistara Infinite card on detail. Let’s compare the returns rate of these two cards. Let’s see which of these two cards is better.

1) joining fee –

joining fee of IndusInd bank club vistara explorer card RS.40,000 plus taxes, and the renewal fee is Rs.10,000 plus taxes. Axis vistara infinite card joining and Rent both there are Rs.10,000. Joining fee is higher than Induslnd bank club vistara’s Axis vistara infinite card .

2) welcome benifits –

indusind bank club vistara explorer credit card review 2023-2024 IndusInd bank vistara explorer card on club vistara gold membership, complimentary vistara business class ticket, oberol hotel stay voucher or luxe gift vouchers worth Rs.25000 or vouchagram gift voucher worth Rs.25000 Can like Myntra, aldo, etc.

If you consider a business class ticket for Rs.50,000, your joining fee is recovered. Axis vistara infinite card get club vistara gold membership and complimentary vistara business class ticket. But the joining fee of this card is only Rs.10,000 so you get better return than joining fee.

So on the basis of welcome benefit Axis vistara infinite card is better. On IndusInd bank club vistara explorer card you get first year cv gold membership. But you have to do the required number of flights in one year. If you have not done so many Fights then your membership is down grade in cv silver membership.

This is a huge disadvantage. Club vistara gold membership is a great benefit for frequent flyers. Due to this, it is a great disadvantage that club vistara gold membership is not available on this card every year

3) Other Benefits–

Buy one get one ticket book on IndusInd Vistara card, you can get maximum two ticket on one show in one month. Get Easy Diners Benefits With this card you can get RS.3000 discount on dinning at selected restaurants and avail this benefit twice a year.

You get priority pass membership on IndusInd vistara card. This gives you 16 free international lounge axis in one year. Such benefits are not on the axis vistara infinite card. IndusInd card is better in this point.

4) Milestone Benefits–

InclusInd vistara card you can earn total Five business class Tickets vouchers in one year at Rs.3 lakh spends each. You will get one business ticket voucher.

You can earn a total of four business class ticket vouchers on Axis vistara infinite card in one year. For that you have to pay Rs.2.5 lakhs, RS. 5 lakhs, Rs.7.5 lakhs, Rs.12 lakhs spends in one year. You can earn more tickets on IndusInd card but the milestone of Axis Vistara Infinite card is comparatively easily achievable.

5) Rewards –

indusind bank club vistara explorer credit card review 2023-2024 Normal spends rewards on IndusInd bank vistara card. 200 Spends but if you spend on Vistara you get 8 CV points. On every Rs.200 spends. 6 cv points on hotels, airlines and travel spends you can earn on every Rs.200 spends. 1 CV points on every RS.200 spends on utility bill, insurance and fuel.

In compare to Axis new vistara infinite card reward structure is very simple. You get 6 CV points on every spends except fuel surcharge and wallet loading on all spends on every Rs.200 spends. The reward structure of Axis vistara infinite card is better than IndusInd band Vistara because it does not have many complications. You can earn good CV points only on travels centric category on IndusInd bank vistara card.

6) Return rate –

1) First case– In first case if one person spends Rs.40,000. in these spends. Rs.10,000 vistara spends upwards, Over Rs.10,000 hotel and travel, Rs.8,000 utility bill, above Rs.7000 fuel, Rs.15000 others spends. From this expenditure, in one month, he can earn theoretically maximum total 925 CV points on Person IndusInd bank vistara card.

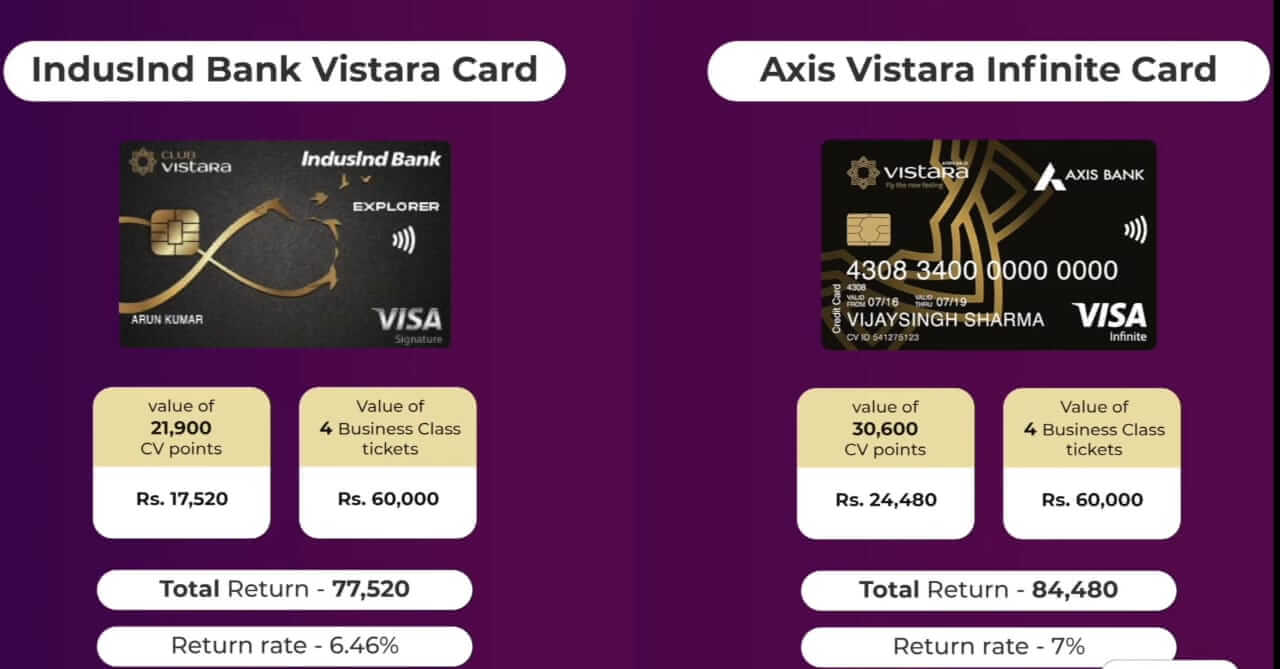

If you spend this using Axis bank vistara card then you can earn theoretically maximum total 1290 cv points. In complete one year IndusInd bank can earn 11,100 CV points on vistara card and 15480 cv points on axis vistara infinite card. Plus you will get Business class ticket vouchers on both the cards.

If you consider flight from Delhi to Mumbai, you will get a ticket for 5000 CV Points. If the price of this ticket is 4000 then one cv point value is 0.80 Paisa. Assuming one Business class ticket value 150,000. Considering all this, you get 6.48% return on IndusInd bank vistara card And on axis vistara infinite card you get around 7% return .

2) Second case –

If a person spends Rs.700,000. Among them RS.15000 vistara, RS. 15000 travel, RS.12000 utility bills, Rs.1000 Fuel and Rs.18,000 other spends. From this cost you will get a total of 1340 cv points on IndusInd bank vistara card. Axis vistara card will get a total of 1800 CV points.

In a complete year, IndusInd Bank Vistara Card will get 16,080 CV Points and Axis Bank Vistara Card will get 21,600 CV Points. Considering all this, you will get 5.2% return rate on IndusInd bank vistara card. Axis Vistara Infinite card offers 7.4% return rate.

3) Third case –

If a person pays Rs.1 lakh in one month spends Rs.20,000 on Vistara tickets RS.20,000 above Rs.20,000 on utility bill, Rs.15,000 on fuel, Rs.25,000 on other spends. So he will get 1825 CV Points and 2550 CV Points on Axis Vistara Infinite Card.

Total complete one year will get 21900 CV points on IndusInd vistara card and 30,600 CV points on Axis vistara infinite card. Considering all this, the total return will be 6.46% on IndusInd bank vistara card and 6% on Axis vistara Infinite card.

7) Conclusion –

Axis vistara infinite card has better return in most cases. For simplicity you have not considered Axis vistara infinite card 1st year Rs.10000 bonus points. And in all cases travel expenses of the higher side are taken on vistara. Indusand card has good benefits like book my show, easy dinner but its joining fee is very high so this is a negative point. Of these two cards, Axis vistara Infinite card is better.