Slice vs uni pay credit –

Slice vs uni pay credit card which is better 2023-2024 There was a lot of confusion between slice and Uni pay card which card is best. Slice and uni pay card not exactly credit card. In both these cards a credit line is given. And a physical or virtual card is issued to use this limit. Uni card is basically pay 1 / 3rd card.

You can spend 45000 rupees in this month and you can repay 15000 rupees a month for the next three months, without interest rate. The same facility is available on the slice card. In slice card you can extend EMI for 6,9 or 12 months. If EMI is extended in slice card after 3 months, extra charge has to be paid. Both two cards do not provide international transactions and cash withdrawal.

These cards slice and pay no credit card so you cant add on cread app. To clear a bill of card you have to use his app’s. Slice has slightly advantage compare to uni pay card here as it offers EMI for more than three months.

Eligibility –

Slice vs uni pay credit card which is better 2023-2024 Cibil score is not required for both these cards. There is a difference between not having a score and having a low score. If your score is below than 600–700 then you could face some difficulty in getting accepted for either of these cards.

To apply slice cards your age have to minimum 18 years and for uni card the minimum age is 21 years. Here you can see slice has light advantage over uni pay card.

Ease of applying–

These both cards, slice and unipay card available in android and ios. The application for the cards is very easy. To apply first you have to download the app and open it.

Follow the steps and process will be done in five minutes. After you apply successfully the virtual card will be available immediately and the physical card will reach you in some time. The best part of these to apps is you can choose your delivery address.

If you don’t want to address will be the same as an aadhar card. You can also check the cities both cards are delivering you. The physical card of slice delivered to 38 cities and UNI pay card in 36 cities.

Features : –

Slice vs uni pay credit card which is better 2023-2024 Many peoples known UNI pay card offers one percent cash back if you pay your entire bill on time or before due date. Slice card offers two percent cash back if you pay your entire bill on time. UNI pay card offers one percent cash back on unbilled amount.

Slice card offers you reward points. These reward points are called as “Monies”. These Monies you have to redeemed for cash. UNI pay card offers you all your transaction one percent discount. Slice card doesn’t offer you cash back for wallet load, rent payment and fuel surcharge.

The rate of rewards of slice card is one percent. The reward conversion of slice monies to the cashback is a depends upon the balance.

The balance you have in your slice account If your monies of slice account is above three lakhs then the reward rate will go up from one percent to 1.50 percent. If the slice monies is go upto five lakh the reward rate will go to two percent.

Slice card only says higher cashback but in practice it is equal to or lesser than UNI pay card. Because of this uni card slightly advantage. Slice card has one more advantage is that it offers something called spark benefit.

Spark benefit is basically discount on the UBER, Amazon and zomato. Uni card does not make any such offer. There is no such discount.

Bill payment options: –

This is important factor because he told which company is more flexible in terms of payment option. In slice card after generating the bill this bill, you have to clear in three days.

You cannot pay the bill before it is generated. This means you have three days to pay your bill in the case of slice card. In uni pay card you can pay your own bill anytime.

Uni Pay Card has the option to split the payment. You get Flexibility How are you going to make payment plan. After the generate bill you have to ten days to pay bill in uni pay card.

Charges –

Most of the peoples know that these cards charge Zero joining and zero renewal Fees. A few days ago, the CEO of Uni card announced that they will start charging 2000–3000 joining fee from Jan 2022.

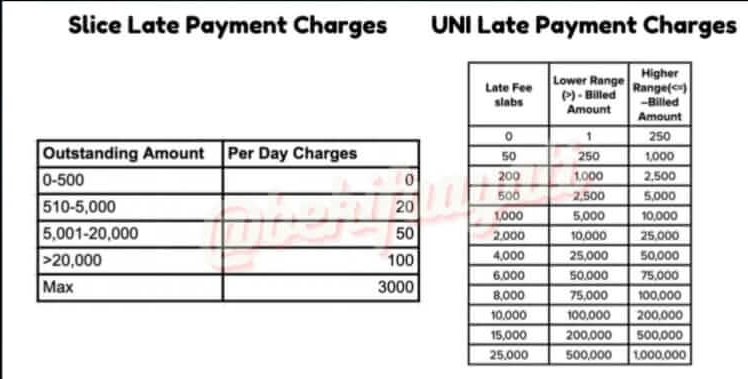

If you make late payment, you will be charged on Slice card per day and will be charged like uni card cycle. Slice has maximum charge of 3000.

This means that if your delay is less then the charge is reduced but if the delay is too much then charge is too much.

Bank Transfer –

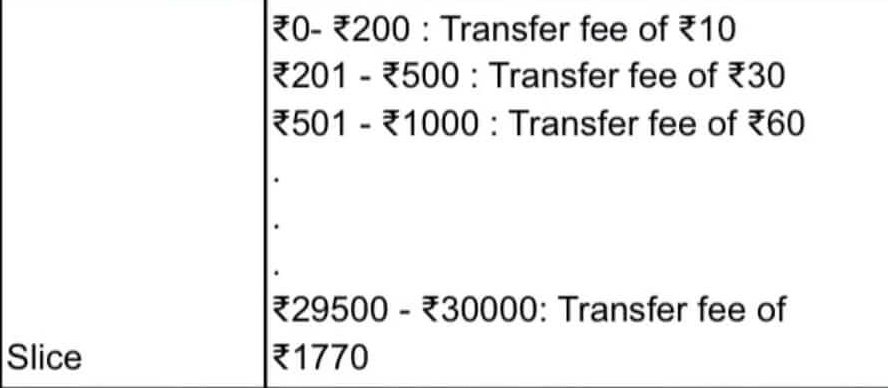

There is no bank transfer option in uni pay card. In slice card you can transfer money from its wallet to any other bank account. To transfer the money to bank slice gets charge.

This charge is very high. It is ten to twenty percent. It’s very high comparison to RTGS, IMPS but uni pay has no option. Uni pay card offers are limited.

But this is a very good card Because there are no hidden charges. There are too many offers in slice card. But the charges and the structure are very complicated. Slice card has hidden fees and charges.

If your requirements are being met through uni pay card then you can get uni pay card. It is more transference great app and support staff. Also done a detailed comparison of all the Buy Now pay Later APPS.

Slice app – slice app user is very good because they are very old in the market. This app works very well after update. Uni card APP: – This card is now on better stage.

User expiration is not very high. But we will get user expiration very soon. Both these cards are available in iOS and Android. You can install and use apps on any device you have available. Both are Card Visa Powered. Benefits of visa are both these cards get. Domestic transactions are done in a very good way online or offline.