Why should you have a credit card in 2023-2024 Because When you do not have cash, the credit card helps you. Even if you have cash, you can use a credit card.

You can use credit card for online or offline purchase. Basically credit card is plastic or metal card similar looks like debit card. But it is a credit instrument.

How credit card works –

The bank gives you a loan from a credit card. The bank gives you a credit limit. In which you get x amount to spend. This x amount is decided by the bank. The credit limit is determined by factors such as bank income, credit history, Assets income tax return.

Why should you have a credit card in 2023-2024 When you spend, that amount is not debited from your bank account. This amount is debited from the credit limit. Whatever credit card you spend or due amount you have to pay to the bank. After generating the statement.

You have to pay the full amount due before due date. Payment due date, 15–20 days after statement is generated. If you pay the full amount due date before, you do not have to pay any interest charge.

Example –

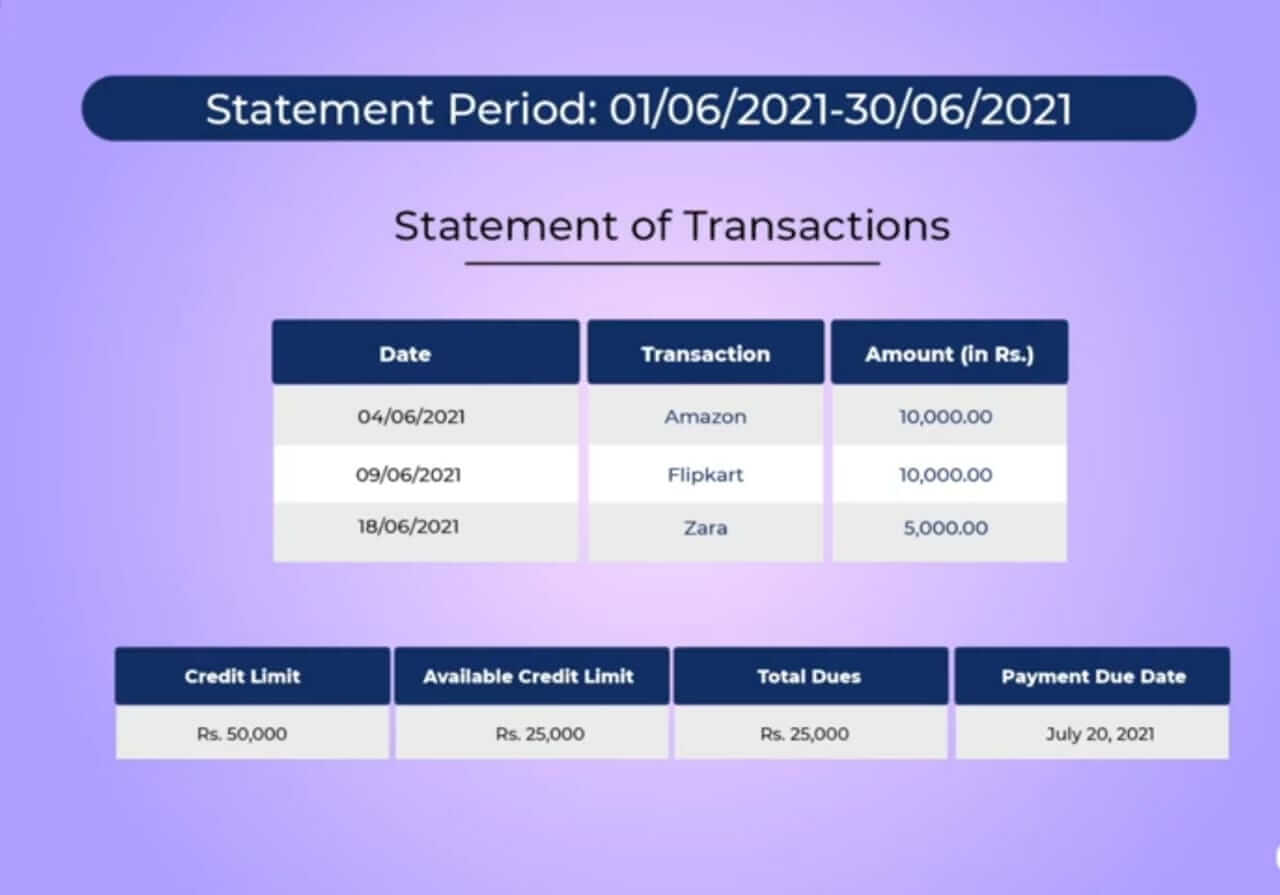

1 . Suppose credit card statement period is 1/6/22 – 30/6/22 and your credit limit is 50,000. This means you can purchase 50,000 credit limit in 1 to 30. Suppose you made rs.10,000 purchases on 4th June. Your available credit limit will be Rs.40,000. This means you can do rs.40,000 more purchases.

Suppose if you make more purchases of Rs.10,000 on 9th June, then your available credit limit will be Rs.30,000. Suppose Purchased Rs.5,000 on 18th June.

If your available credit limit is 25,000 rupees and total credit card limit use 25000 rupees. All your statement of Spend from 1st to 30th June will be generated on 1st July. Which will mention the details of all your transactions. Minimum due amount and total due amount will also be mentioned .

2 . Suppose your due date is 28th of July. If you pay the total amount due before this date then you do not have to pay any interest rate. From this you will understand that you can get free credit limit from credit card for 45 to 50 days.

3 . Suppose if you spend using credit card on 4th June, you will have to make the same payment till 28th July. This gives you a lot of time to pay. And even the interest rate is not a pity. When you make a payment, that payment is added to your credit card limit.

4 . For example– if you make full payment on 15th June. After that if you have not spent any more then your total credit limit 25000rupees + 25000rupees = 50 rupees.

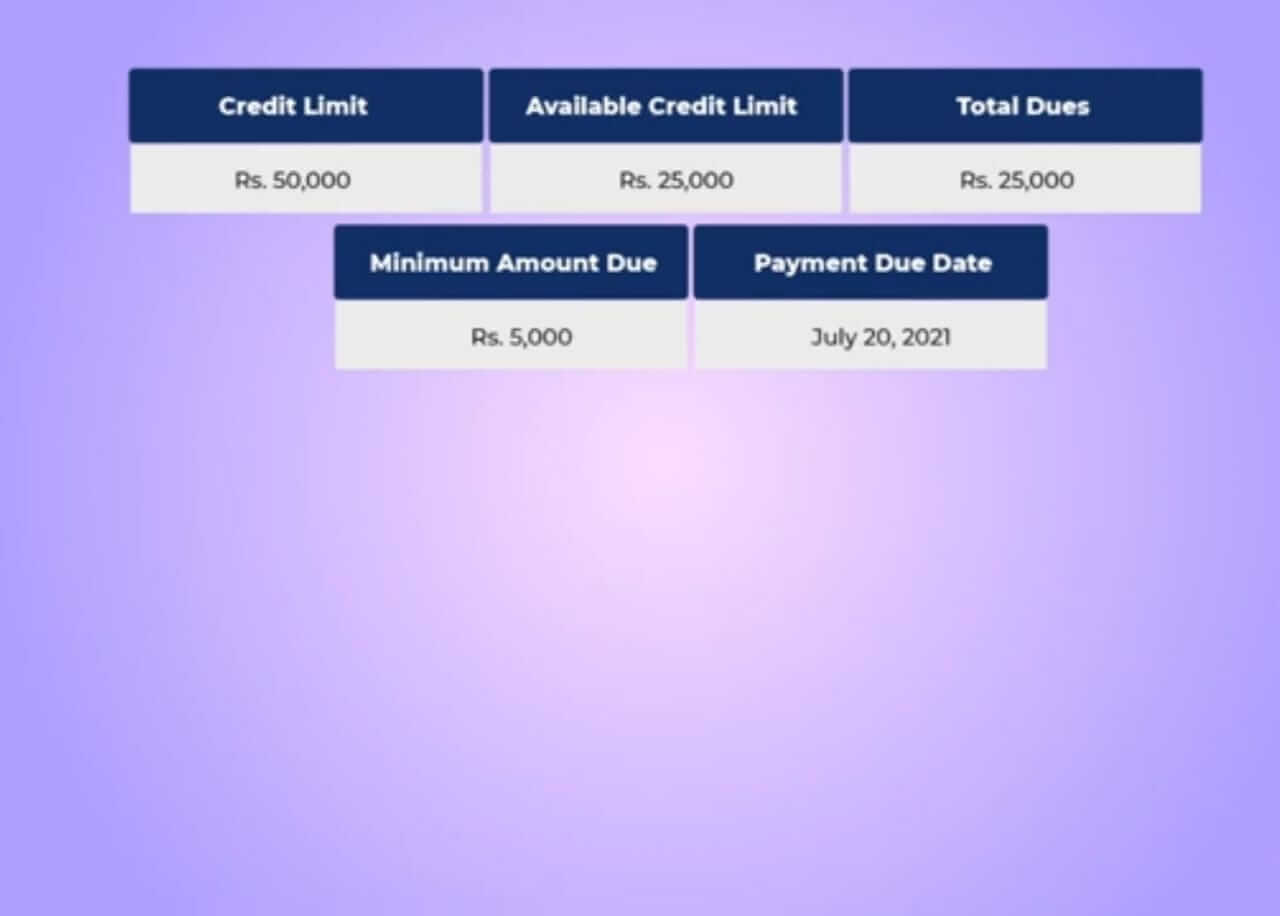

What is Total amount due and minimum amount to due : –

Why should you have a credit card in 2023-2024 Let us see an example to understand this. suppose total amount due rs.25,000 and the minimum due amount 5000rupees. The minimum amount means that you have to pay this amount to the bank.

If you do not pay this minimum amount to the bank, then this credit default will be considered. This will damage your CBIL score and the bank may take legal action against you. So you have to pay minimum amount.

What’s the difference between minimum amount due and total amount due –

Why should you have a credit card in 2023-2024 If you pay the minimum amount without paying the total amount, then your balance amount is still needed to the pay bank. The bank charges interest on this amount.

Example –

minimum amount due rs.5000 paid to bank but total credit amount is Rs.25000 So the difference amount that is 20000 rupee will charge bank interest. If you pay more than the minimum amount due. Suppose you pay Rs.15000 so your difference amount is 25000–15000 = Rs.10,000. This rs.10,000 on bank interest rate.

The bank charges a very high interest rate on credit cards. Only one advice please pay your total amount before your due date.

Benefits of credit cards –

1 . Interest free credit– interest is changed on almost all loans like education loan, home loans, car loans. Which you have to pay regularly. But there is no interest charge on credit card. If you pay all your bills due date, then interest charge is not charged. Use responsibly and reap the benefits.

2 . Welcome offers – You get welcome benefits, bonus reward points, discounts, gift vouchers on almost all credits cards. For example you get free amazon memberships, swiggy super and hotel discounts on some credit cards. Some credit cards also carry hotel bookings, discount vouchers, shopping vouchers and movie tickets.

3 . Airport lounge access– you get complementary lounge visit at most of the credit card domestic and international airport. Priority checking’s, lounge access and many different benefits. All these benefits are available exclusively on travel enteric or premium cards.

4 . Reward points and cashback – When you shop on credit card, you get reward points, cash backs, gift voucher. You can get merchant avail and gifts voucher by using this reward point. So when you shop, use credit card because it gives you a lot of discounts, cashbacks.

5 . Insurance – Insurance is also available on many credit cards. He cover on insurance accident on well, hospitalization, air accident, accidental death cover, fire and purchase item. This insurance provides protection against theft. You have to meet the minimum spending requirement to get this benefit.

6 . Cash withdrawal– Atm through cash withdrawal from credit card. You can use credit card when you need urgent cash. You have to pay interest rate and fee charge on cash withdrawal from credit card. You can transfer credit card balance to your bank account. You can transfer money to your bank account by using this application.

7 . add on cards – on most of the credit cards you get the facility of supplementary card. You can give this supplementary card to family members. You can give this supplementary card to family members. These supplementary cards have all the benefits of the primary cards.

8 . EMI Conversion – You can pay through EMI on top of the items you have taken or on the loan. Some credit cards provide zero EMI charges facility.